Debt-Free Starts Here

Paying off debt can feel overwhelming—but a clear plan makes it achievable. Use our free Debt Payoff Calculator to explore different strategies, see how extra payments can shorten your payoff timeline, and discover how much interest you could save along the way.

Three Ways to Attack Your Debt

There’s more than one way to pay off debt—and the right approach depends on your goals and motivation. Each method below can help you reach debt freedom, but they work a little differently. Try them in the calculator above to see which fits your situation best.

Minimum Payments Only

Paying just the minimum each month keeps you current but traps you in debt longer. Most of your payment goes to interest, so balances barely move. It’s fine while you’re building an emergency fund or steadying your budget—but it’s the slowest, most expensive route to debt freedom.

Debt Snowball Method

With the Snowball Method, you pay extra toward your smallest balance first while keeping up minimums on the rest. Every time you knock out a debt, you roll that payment to the next one—building momentum fast. This method helps you free up monthly margin sooner and stay motivated with early wins.

Debt Avalanche Method

The Avalanche Method targets your highest-interest debts first to save the most money overall. Once a high-rate balance is gone, you move to the next one—cutting interest costs and speeding up your timeline. Progress may start slower, but the long-term savings are hard to beat.

Frequently Asked Questions

What types of debt can I include in this calculator?

You can include credit cards, student loans, personal loans, auto loans, and more. Any debt with a balance, interest rate, and minimum payment can be added.

What’s the difference between the Avalanche and Snowball methods?

The Avalanche method prioritizes paying off the highest-interest debts first, saving the most money on interest. The Snowball method focuses on the smallest balances first, giving quick wins to keep you motivated.

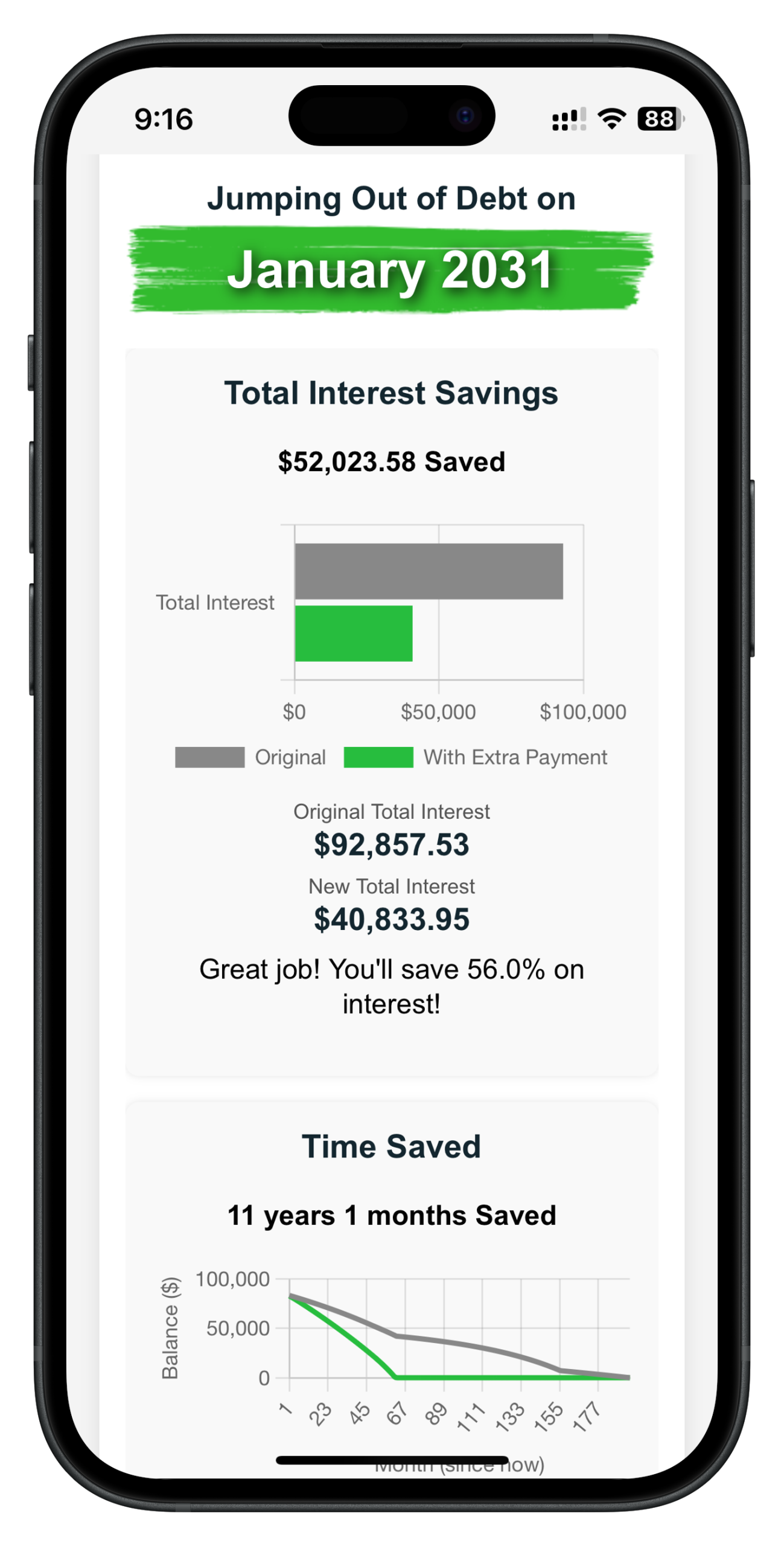

Can I see how extra payments affect my payoff timeline?

Yes! You can enter extra monthly or one-time payments, and the calculator will show how much faster you could become debt-free and how much interest you could save.

How accurate is the calculator?

The results are estimates based on the data you provide. Actual payoff may vary if interest rates change, payments are inconsistent, or fees apply, but it gives a realistic roadmap.

Can I use this calculator if I have multiple debts?

Absolutely. The tool allows you to add as many debts as needed, helping you see the combined impact on your total payoff timeline and interest savings.

Is my debt information private?

Absolutely. All data entered into the calculator stays on your device and is not stored or shared. You can use the tool safely without creating an account or providing personal information.

Take Your Debt Planning Anywhere

Manage your debt on your terms with our Debt Payoff App — designed to work seamlessly on any phone or tablet.

- Save Your Progress Securely: All your inputs are stored safely on your device, so you can return anytime to continue where you left off.

- Edit and Update Instantly: Adjust balances, interest rates, or payments and see updated results immediately — no need to start over.

- Your Calculations, Always at Hand: Whether at home, on the go, or planning your next financial move, your debt snapshot is just a tap away.

💡 Tip: Add the app to your phone’s home screen for quick access, just like a native app — and keep your financial plans within reach.

Want to turn projections into action?

We’ll help you understand your numbers, prioritize steps, and create a roadmap that makes your money work smarter for you.

This calculator is for educational purposes only. It’s not financial advice. Results are estimates and may vary based on real-world factors. Consult a qualified advisor before making investment or retirement decisions.